In recent years, economic and trade cooperation between the United Kingdom and Viet Nam has deepened, marked by stronger policy alignment and expanding market access. Building on the UK-Viet Nam Free Trade Agreement (UKVFTA) and the UK’s accession to the CPTPP in 2024, bilateral relations continue to gain momentum in 2025. This offers new opportunities for small and medium-sized enterprises (SMEs) in both countries.

Bilateral Trade Snapshot: First Half of 2025

In the first half of 2025, total bilateral trade between the UK and Viet Nam reached $4.3 billion, representing a 9.6% year-on-year increase. [1] This growth signals continued confidence and engagement from businesses on both sides.

Key trade agreements have played a central role. The UKVFTA has reduced tariffs on up to 99% of UK goods exported to Viet Nam, while the UK’s CPTPP membership has further streamlined access to the broader Asia-Pacific market.

UK exports to Viet Nam have seen growth in high-demand sectors:

- Food and drink: Leveraging tariff-free access and rising consumer appetite.

- Pharmaceuticals: Supported by regulatory cooperation and reduced trade barriers.

- Consumer goods and cosmetics: Aligning with Viet Nam’s expanding middle class and demand for quality imports.

These trends tell a bigger story. Not only the resilience of UK–Viet Nam trade ties, but also the widening space for SMEs to enter or scale in Viet Nam’s dynamic marketplace.

Policy Milestones Fueling the Momentum

Strategic policy developments in 2025 have continued to shape and accelerate UK–Viet Nam trade relations, providing a stable framework for long-term cooperation.

One of the key drivers is the UK-Viet Nam Free Trade Agreement (UKVFTA), which remains a foundational element of the bilateral economic partnership. Now in its fifth year of implementation since entering into force on 1 May 2021, the agreement has significantly reduced trade barriers. Up to 99% of UK exports to Viet Nam now enjoy zero tariffs. This covers major sectors such as pharmaceuticals, consumer goods, and agricultural products.

In parallel, the UK’s accession to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in early 2024 marked a new phase of economic integration. As the 12th member of this high-standard regional trade bloc, the UK gains access to preferential terms across the Asia-Pacific. By extension, UK firms operating in Viet Nam can benefit from streamlined rules of origin, digital trade frameworks, and broader market networks.

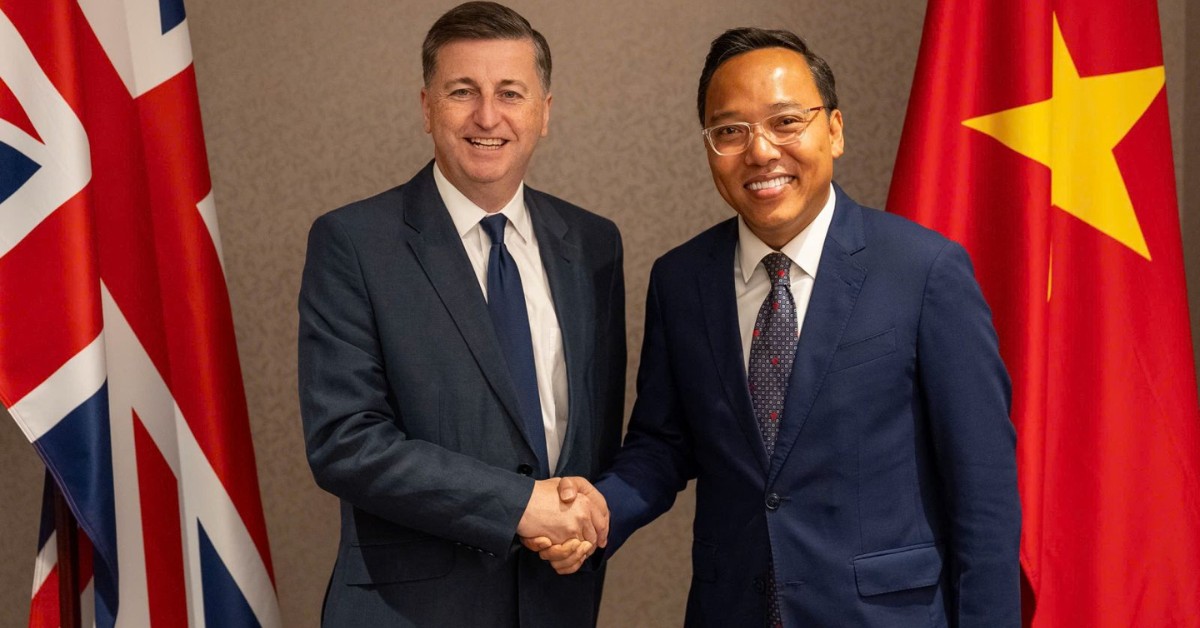

On July 14, 2025, the 14th Viet Nam-UK Joint Economic and Trade Committee (JETCO) meeting was held in London, co-chaired by Viet Namese Deputy Minister of Industry and Trade Nguyen Hoang Long and UK Minister of State for Trade Policy Douglas Alexander. Both sides reaffirmed their commitment to expanding cooperation in:

- Agriculture and food safety

- Healthcare and pharmaceutical regulation

- Banking, green finance, and digital services

- Renewable energy and the energy transition

- Trade promotion and investment facilitation

Notably, the UK government announced a trade win enabling up to £250 million in exports for British pharmaceutical firms through regulatory alignment with Viet Nam, further underscoring the tangible outcomes of this cooperation. [2]

These milestones reflect a coordinated approach to unlocking bilateral trade potential and ensuring that both large enterprises and SMEs can navigate the market with greater clarity and support.

High-Potential Sectors for Viet Nam-UK SMEs in 2025 and beyond

As trade relations deepen, several sectors stand out for their potential to drive two-way commercial collaboration – particularly between small and medium-sized enterprises in the UK and Viet Nam. These industries benefit directly from tariff reductions, regulatory cooperation, and complementary strengths between the two economies.

Pharmaceuticals

In July 2025, the UK secured a landmark trade win with Viet Nam by successfully removing key barriers in the pharmaceutical sector. According to the UK government, this agreement unlocks around £250 million worth of export opportunities for British pharmaceutical companies over the coming years, particularly in prescription drugs and medical devices. [3]

The deal eases long-standing hurdles for foreign businesses, particularly those from the UK, in Viet Nam’s healthcare sector, including import licences and regulatory approvals, as well as transparency. As a result, UK pharma SMEs now have improved access to a fast-growing market, which is projected to grow from approximately USD 6.4 billion in 2024 to around USD 9.4 billion by 2029, with a compound annual growth rate of 8%, according to BMI (Fitch Solutions) forecasts. [4]

On the Vietnamese side, the agreement facilitates technology transfer, clinical partnerships, and better supply chain integration, which is key to improving healthcare quality and affordability.

Renewable Energy & Green Finance

The UK’s global strengths in offshore wind and sustainable finance provide a strong foundation. Building on this, both governments have committed to deeper cooperation in the energy transition. Viet Nam’s Power Development Plan VIII sets an ambitious target of 17,500 MW offshore wind capacity by 2035, creating demand for engineering, consulting, and financing services.

UK SMEs operating in renewable energy technology, project design, or green finance advisory are well-positioned to support Viet Nam’s net-zero transition. Through the Just Energy Transition Partnership (JETP), more than USD 15.5 billion has been committed to help Viet Nam scale its clean energy ambitions – backed in part by UK financial institutions. [5]

Clean Agriculture & Logistics

Viet Nam’s agricultural sector is increasingly shifting towards sustainability and food safety compliance – areas where UK firms can offer value. Opportunities lie in post-harvest processing, cold-chain logistics, and traceability solutions for export-oriented farming.

Meanwhile, with growing demand from international buyers and free trade agreements easing access, Vietnamese SMEs in agrifood can benefit from partnerships with UK tech providers and consultants to modernise operations.

Consumer Goods

Rising incomes and urbanisation in Viet Nam continue to fuel demand for premium imports. UK brands in food & beverage, personal care, and lifestyle products have seen strong growth, thanks to tariff eliminations under the UKVFTA and increasing brand recognition.

For Vietnamese SMEs, collaboration with UK partners offers potential in distribution, retail franchising, and product co-development, targeting a broader regional market via the CPTPP framework.

What This Means for UK SMEs

The evolving UK-Viet Nam trade landscape presents concrete, near-term advantages for small and medium-sized enterprises (SMEs) from the UK. With the UK-Viet Nam Free Trade Agreement (UKVFTA) and the UK’s recent accession to CPTPP, the regulatory and tariff environment has become more SME-friendly than ever.

Reduced tariffs and streamlined procedures mean UK SMEs can now access the Vietnamese market with lower operational costs and fewer administrative hurdles. For many exporters, especially those in food and drink, pharmaceuticals, and consumer goods, this translates into enhanced price competitiveness and faster market entry.

Beyond tariff benefits, strategic sectors such as renewable energy, green finance, agriculture, and health tech are emerging as high-potential areas for collaboration. In this field, UK SMEs can contribute specialised technologies, consulting expertise, and niche solutions.

Moreover, as Viet Nam continues to modernise its domestic supply chains, demand is rising for collaboration with international partners, especially in logistics, quality assurance, regulatory advisory, and digital transformation. UK SMEs offering flexible, high-value solutions are well-positioned to capitalise on emerging partnership opportunities, either directly or through local intermediaries.

In short, a combination of trade policy developments, emerging sectoral opportunities, and Viet Nam’s economic trajectory presents a favourable context for UK SMEs exploring regional growth. Viet Nam is increasingly viewed as a strategic gateway to accessing broader Asia-Pacific markets.

Conclusion

The UK–Viet Nam trade partnership in 2025 reflects steady progress supported by long-term frameworks such as the UKVFTA and CPTPP. Bilateral cooperation continues to expand across key sectors, offering a favourable environment for both sides to explore mutual opportunities. As policies evolve and markets expand, businesses can benefit from staying informed and identifying sectors that align with their capabilities

References

[1] UK Government Trade & Investment Factsheet, 1 August 2025. https://assets.publishing.service.gov.uk/media/688ac699b223ff124d38892d/vietnam-trade-and-investment-factsheet-2025-08-01.pdf

[2] GOV.UK. Trade win unlocks £250 million for British firms in Vietnam. https://www.gov.uk/government/news/trade-win-unlocks-250-million-for-british-firms-in-vietnam

[3] Reuters. UK agrees deal with Vietnam to remove pharmaceutical trade barriers. https://www.reuters.com/business/healthcare-pharmaceuticals/uk-agrees-deal-with-vietnam-remove-pharmaceutical-trade-barriers-2025-07-13/

[4] Fitch Solutions. UK-Vietnam Pharmaceutical Trade Agreement and Market Analysis, 16 July 2025.

[5] GOV.UK. International Agreement to Support Vietnam’s Ambitious Climate and Energy Goals. https://www.gov.uk/government/news/international-agreement-to-support-vietnams-ambitious-climate-and-energy-goals