In an era marked by global uncertainty, geopolitical tensions, supply chain realignments, and shifting capital flows, businesses and investors are no longer seeking only opportunity. They are prioritising stability, predictability, and trusted long-term partners.

Within ASEAN, where competition for foreign direct investment (FDI) is intensifying, Viet Nam distinguishes itself through a rare combination: enduring political stability, steady economic performance, and a forward-looking commitment to openness and integration. This balance not only sustains investor confidence but also elevates the country as a reliable anchor in a rapidly changing global economy.

The question, then, is not whether Viet Nam is stable, but why global investors increasingly view it as a strategic partner for long-term growth. This article explores three defining strengths that underpin Viet Nam’s resilience: political and social stability, a young and adaptive workforce, and progressive integration with global markets.

Stability and Safety: The Foundation of Trust

Few emerging markets can match Viet Nam’s long-standing record of political and social stability—an advantage that continues to reassure global investors. In a world where many economies face policy uncertainty or geopolitical disruption, Viet Nam offers the predictability businesses need to plan with confidence.

This stability is reflected in robust investment flows. In the first half of 2025, registered foreign direct investment (FDI) reached US$21.5 billion—the highest level in 16 years and a 32.6% year-on-year increase [1]. By August 2025, inflows had already surpassed US$26.1 billion, marking a surge of 27.3% compared with the same period in 2024 [2]. At a time when FDI into several ASEAN economies is plateauing or slowing, Viet Nam’s sustained growth underlines its position as one of the region’s most attractive destinations.

International institutions consistently affirm this outlook. The World Bank highlights Viet Nam’s resilience and steady growth trajectory, while Fitch Ratings maintains a positive credit profile, underscoring the country’s reliable macroeconomic fundamentals.

For global enterprises weighing risk against return, Viet Nam represents more than just a safe haven. It provides a stable foundation for expansion and long-term strategy, a reliable anchor in a shifting global economy.

Young and Dynamic Workforce: Viet Nam’s Long-Term Edge

A nation’s future is written by its people, and Viet Nam’s strength lies in its youth. In 2025, the median age is about 33.4 years [3], keeping the workforce relatively young. Combined with high labour force participation and improving education, this demographic profile remains a core advantage.

Higher education continues to expand rapidly, with more than 2 million students enrolled in universities a pipeline steadily feeding both service industries and high-tech manufacturing [4].

Labour cost competitiveness remains a key driver of Viet Nam’s investment appeal. In 2025, the country’s regional minimum wages range from VND 3.45 million to 4.96 million (approximately US$132–190 per month) [5], placing Viet Nam well below many peers and reinforcing its role as a cost-efficient hub. Comparative studies show that firms can achieve up to 50% labour cost savings compared with China [6], a decisive factor for manufacturers seeking diversification.

Adaptability and skills are equally important. Viet Nam has been investing heavily in STEM education and vocational training, and leading multinational enterprises—such as Samsung and Intel—are partnering with local institutions to shape programmes in advanced manufacturing and R&D.

For businesses navigating digital transformation, this mix of youthful capacity, cost advantage, and rising productivity offers Viet Nam not merely a short-term bonus, but a structural foundation for long-term partnership.

Open Policies and Global Integration: Unlocking Growth

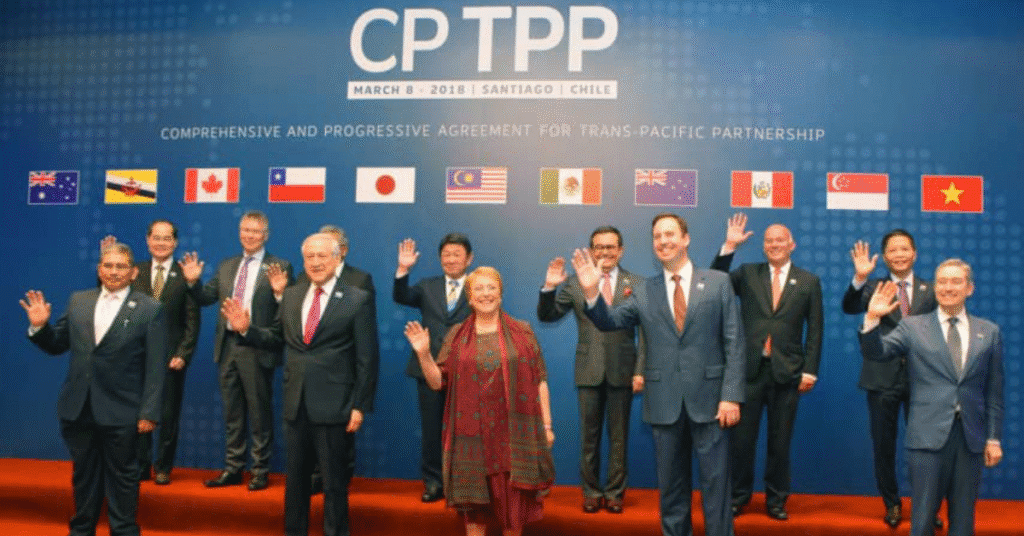

Open policies and deep international integration increasingly support Viet Nam’s economic rise. Free trade agreements such as CPTPP, EVFTA, and UKVFTA have not only lowered tariffs but also aligned the country with global norms, giving investors confidence and smoothing trade and investment flows.

A notable example is the EU-Viet Nam Free Trade Agreement (EVFTA), in effect since August 2020. By 2025, nearly 99% of tariffs on goods between the EU and Viet Nam are scheduled for elimination. Since its implementation, bilateral trade between Viet Nam and the EU has reached approximately $298 billion [7], accounting for nearly 40% of the total trade volume between the two sides since 1995.

Key sectors benefiting from these policies include high-tech manufacturing, renewable energy, logistics, and sustainable production. In the first eight months of 2025, registered FDI into Viet Nam reached over US$26 billion [8], reflecting both growth in volume and improved project quality.

Manufacturing and processing remain foundational, bolstered by incentives for smart industrial parks, digital transformation, and public infrastructure investment. These developments position Viet Nam not merely as a low-cost destination, but as a sustainable growth hub within ASEAN, increasingly integrated into global supply chains and driven by innovation and green priorities.

Competing in ASEAN: Viet Nam’s Differentiator

ASEAN remains a highly competitive region for FDI, with countries often emphasising single advantages such as low costs or market size. While these factors matter, relying on one dimension can limit long-term investor confidence.

Viet Nam distinguishes itself through a rare combination of political stability, a skilled and adaptable workforce, and deep integration into global trade networks. This unique mix gives investors not only stability but also confidence to plan for the long term—an edge that remains rare in ASEAN.

Viet Nam is also increasingly recognised for its openness to sustainability, signalling to investors that competitiveness here goes beyond cost efficiency toward resilience and quality-driven growth.

Outlook: Co-Creating a Sustainable Future

Looking ahead, Viet Nam is positioning itself as a trusted partner in global supply chains with a strategic emphasis on high-tech manufacturing, renewable energy, and premium services. These sectors are underpinned by policies promoting green investment, digital transformation, and innovation-driven development, aligning domestic growth with global trends.

Forward-looking programs such as the National Green Growth Strategy and Smart Industrial Park initiatives integrate sustainability into the country’s industrial and service base. These efforts not only create long-term opportunities but also strengthen Viet Nam’s role as an ESG-aligned hub for global investors.

With this vision, Viet Nam positions itself not only as a reliable anchor in a volatile world, but as a co-architect of the future—inviting global partners to build supply chains that are green, digital, and resilient.

Conclusion

In a rapidly shifting global landscape, Viet Nam reaffirms its role as a reliable anchor—grounded in stability, empowered by a young and dynamic workforce, and deeply integrated into global trade networks.

We invite the international business community to partner with Viet Nam in shaping supply chains that are competitive today and sustainable tomorrow, laying the foundation for shared growth and long-term resilience.

References

[1] The Investor. Viet Nam’s registered FDI tops $21 bln in H1, highest in 16 years. July 2025. https://theinvestor.vn/Viet Nams-registered-fdi-tops-21-bln-in-h1-highest-in-16-years-d16221.html

[2] VnEconomy. Viet Nam’s FDI inflows surge 27.3% in the first 8 months of 2025. September 2025. https://en.vneconomy.vn/Viet Nams-fdi-inflows-surge-273-in-8m.htm

[3] Worldometer. Viet Nam Demographics 2025. https://www.worldometers.info/demographics/Viet Nam-demographics/

[4] University World News. Viet Nam: Higher education expands to meet demand for skilled labour. February 2025. https://www.universityworldnews.com/post.php?story=2025020506321851

[5] Viet Nam Briefing. Viet Nam Wages in 2025: Overview, Trends, and Implications. January 2025. https://www.Viet Nam-briefing.com/news/Viet Nam-wages-in-2025-overview-trends-implications.html

[6] InCorp Viet Nam. Viet Nam Labour Costs in 2025. https://Viet Nam.incorp.asia/Viet Nam-labor-cost/

[7] EuroCham Viet Nam. EVFTA turns five: nearly $300 billion in trade and growing. August 2025. https://eurochamvn.org/evfta-turns-five-nearly-300-billion-in-trade-and-growing/

[8] Ministry of Planning and Investment / General Statistics Office (MPI/GSO). Sector-specific FDI data, 2025.